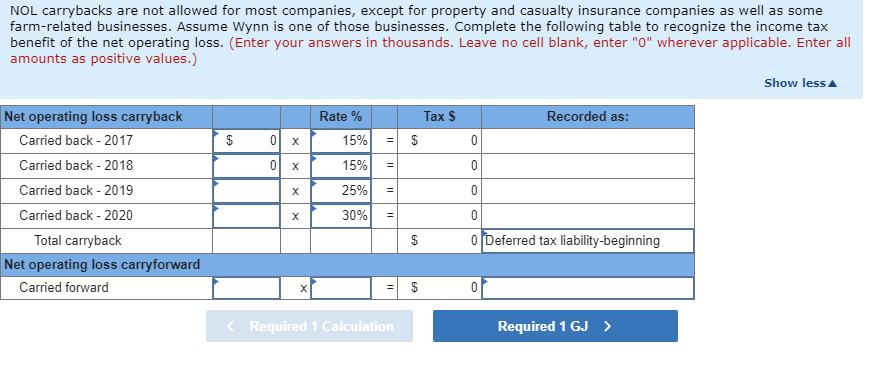

Solved Wynn Farms reported a net operating loss of $160,000

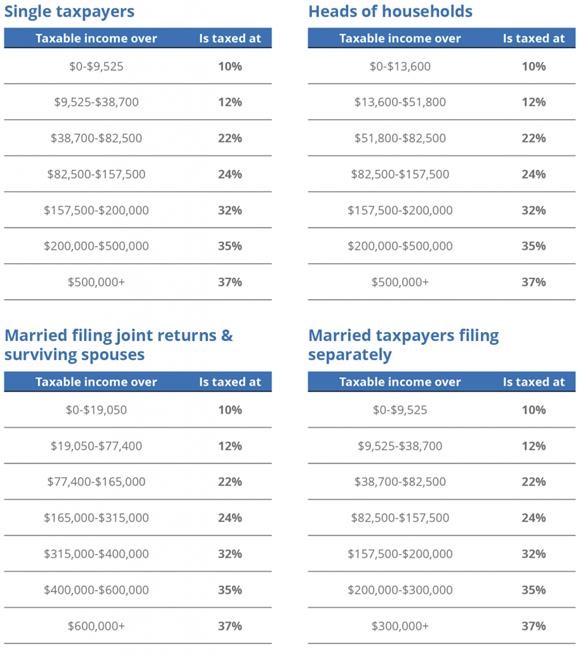

Tax Brackets 2018: How They Impact Your Tax Return Investor's

Federal Tax Rates, Personal Exemptions, and Standard Deductions

Calculation Of Income Tax For Fy 2017 18 - Tax Walls

Michigan's low income tax rate means no problem with new deduction

New income tax rates to be effective from April 1, 2017

2021-2022 Tax Brackets and Federal Income Tax Rates Bankrate

T17-0041 - Average Effective Federal Tax Rates - All Tax Units, By

2017-2018 Tax Tables - American International Group ?? Estate Gift

Individual Tax Provisions in the Tax Reform 'Act' of 2017: A San

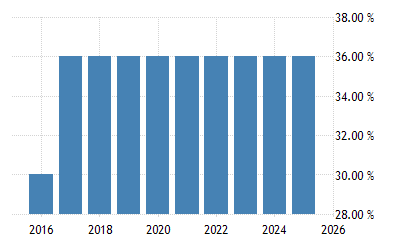

Uruguay Personal Income Tax Rate 2022 Data 2023 Forecast

Income Tax and Capital Gains Rates 2017 - Skloff Financial Group

Tags:

archive