How Federal Income Tax Rates Work Urban Institute

Baseline Estimates Tax Policy Center

Federal Tax Rates, Personal Exemptions, and Standard Deductions

American taxes are unusually progressive. Government spending is

Tax Foundation - Congressional Budget Office shows the 2017

Trump Tax Plan: Four main impacts on MNCs

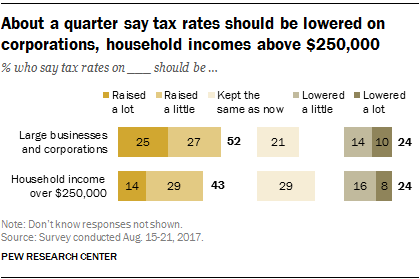

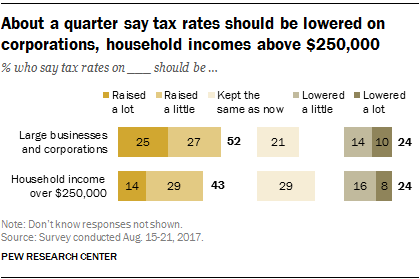

Americans would rather raise than lower taxes on corporations

Americans would rather raise than lower taxes on corporations

High Corporate Income Tax = Less Pay For Workers - Gary D

White House Proposes Slashing Tax Rates, Significantly Aiding

USDA ERS - The Tax Cuts and Jobs Act Would Have Lowered Average

Income Tax Time: Rates Then & Now - Options Edge

Tags:

archive