Long-Term Capital Gains Tax Rates in 2017 The Motley Fool

Individual Tax Rates, Brackets and AMT under the 2017 Tax Reform

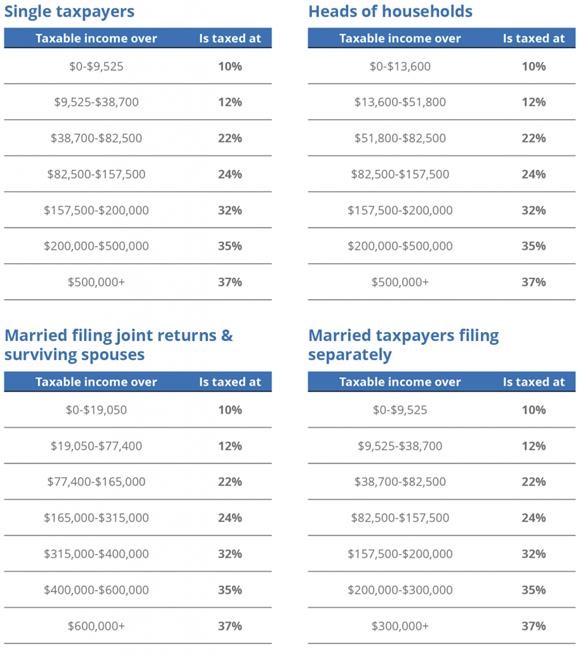

Doshi & Associates, CPA, PLLC - 2017 v. 2018 Federal Income Tax

Individual Tax Provisions in the Tax Reform 'Act' of 2017: A San

Doshi & Associates, CPA, PLLC - 2017 v. 2018 Federal Income Tax

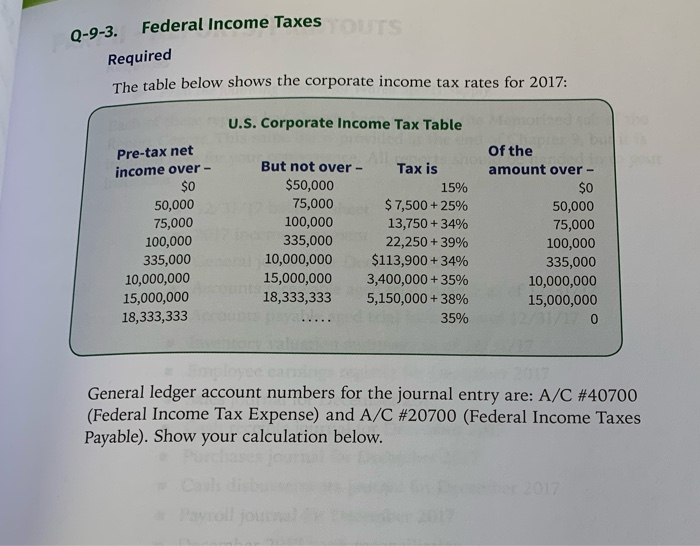

0-9-3. Federal Income Taxes Required The table below Chegg.com

Trump's tax reform priorities unveiled - Journal of Accountancy

New income tax rates to be effective from April 1, 2017

Federal Income Tax Rate History -

Russia-Factograph-Personal Income Tax-Rates-Russia-OECD-2017

Federal Tax Rates, Personal Exemptions, and Standard Deductions

Trump's tax reform priorities unveiled - Journal of Accountancy

Tags:

archive