Michigan's low income tax rate means no problem with new deduction

Thailand's New Personal Income Tax Structure Comes Into Effect

TAX REFORM 2017 - C Corporation Income Tax Rates - Caramagno +

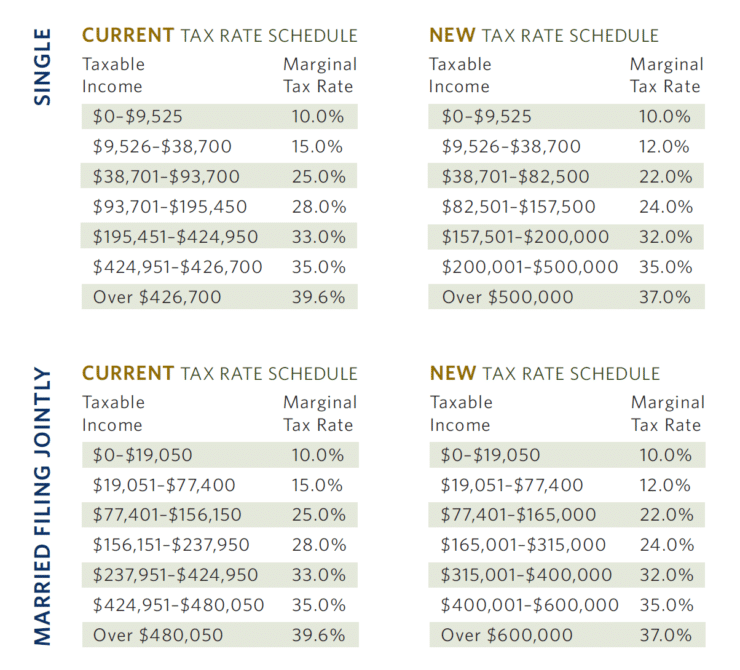

Income Tax Time: Rates Then & Now - Options Edge

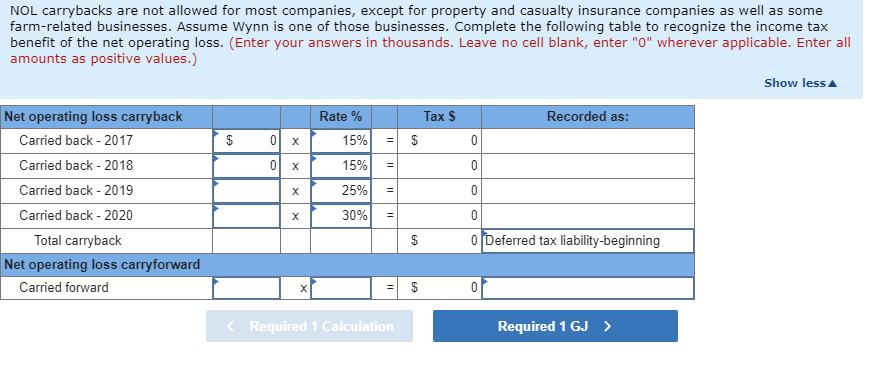

Solved Wynn Farms reported a net operating loss of $160,000

Five Charts to Help You Better Understand Corporate Tax Reform

Final GOP Tax Plan Summary: Tax Strategies Under TCJA 2017

Tax Brackets 2018: How They Impact Your Tax Return Investor's

Effective Business Income Tax Rates in Light of 2017 Tax Law Changes

An Update from the Tax Team: The Tax Cuts and Jobs Act of 2017

Will Lower Corporate Income Tax Rates Increase Business Value?

T17-0041 - Average Effective Federal Tax Rates - All Tax Units, By

Tags:

archive